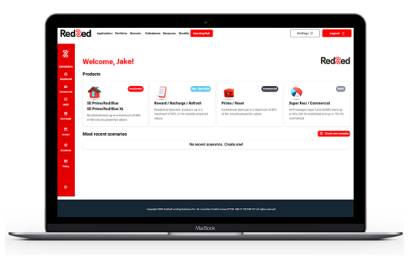

RedZed enhances broker experience with groundbreaking serviceability platform, powered by Quickli

RedZed, a lender for the self-employed, have today announced the launch of its brand-new serviceability calculators developed by Quickli.

Plenti exceeds $400 million in quarterly loan originations

Plenti announce record quarterly loan originations of $407 million, up 42% on the prior corresponding period.

Wisr delivers strong growth and upgrades its FY25 guidance

Reflecting strong year-to-date performance, Wisr is upgrading its guidance to 90%+ loan origination growth in FY25.

MONEYME’s loan book reaches $1.5 billion with originations up 65%

MONEYME’s loan book increased to $1.5 billion, with originations up 65%, while maintaining operating cash profit.

SMEs suffering as Australia’s economy drags: Banjo Loans’ latest Barometer highlights lowest loan applications in FY25

Australian SMEs are grappling with an increasingly tough economic climate, with Banjo Loans’ latest Barometer data highlighting continued anxiety within the sector.

Aussie fintech Bizcap launches in Singapore to bring flexible business loans to SMEs

Bizcap, a leading provider of fast, flexible business loans, has officially launched its Singapore operations.

Rocket Mortgage execs share parallel journey at Lendi Group conference

Lendi Group welcomed senior leaders from Rocket Mortgage to headline its Thrive 25 broker conference in Sydney last week.

OpenSolar and LoanOptions.ai’s new tech partnership brings instant solar financing to homes across Australia

OpenSolar has partnered with LoanOptions.ai to make home energy upgrades simpler and more accessible for homeowners.