Almost two million Aussies use Buy Now Pay Later

The Worldpay 2020 Global Payments Report from FIS has revealed that nearly two million Australians used a Buy Now Pay Later (BNPL) product in 2019.

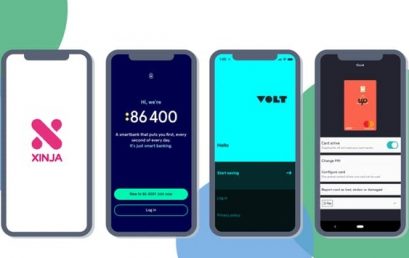

Young savers flock to new wave of neobanks

Young savers are clambering aboard a new wave of Australian digital banks such as Up, Volt, Xinja and 86 400 in recent times.

Platform provider pushes blockchain approach for fee consents

Iress has called for an industry standardised approach based on blockchain, responding to new legislation governing ongoing fee arrangements.

Join the Frollo Open Banking wait list

Frollo announce they’re opening their Open Banking wait list, where you can sign up to be one of the first people in Australia to use Open Banking.

Legal Fintech start-up BarBooks Australia acquires TA Law’s iChambers business

BarBooks, the Sydney based legal fintech company, has acquired barrister practice management product iChambers from TA Law.

Is the Bendigo/Up tie-up an industry benchmark?

Bendigo Adelaide Bank have been winning on the customer acquisition front through its digital bank Up.

Australian Taxation Office to target cryptocurrency investors with audit warnings

Australians are set to receive a stern warning from the Australian Taxation Office in the coming weeks as the tax man takes on cryptocurrency traders.

Why buy now, pay later is so popular with millennials

Millennials are a diverse group of people and it’s these millennials and Gen Zers that are driving the massive growth in buy now, pay later platforms.