Sydney, Melbourne climb in financial, fintech league rankings

There was good news overnight for status-conscious Australia’s bid for relevance in global financial services. Both Sydney and Melbourne continue to climb in the rankings of the world’s leading financial centres, with Sydney nestled in the top 10 at number eight after improving three notches, and Melbourne now ensconced at number 21, also up three places. In another round of the endless rankings of global fintech hubs, Sydney also edged up from 9th to 8th position. Perennial favourites London and Singapore shared top billing, with New York and Silicon Valley at 3rd and 4th, and Chicago the highest new entrant at 5th. The methodology behind country league tables is notoriously […]

Apple Pay leads Digital Wallet usage

Usage of Apple Pay for contactless payments is set to nearly double in 2017, with significantly more users than both Google and Samsung’s digital wallets. Data from Juniper Research indicates Apple Pay will have 86 million contactless users by the end of this year, ahead of the 34 million users of Samsung Pay and 24 million users of Android Pay. Combined, the three digital wallets will surpass 100 million contactless users in the first half of 2017, before surging to over 150 million by the end of the year. Juniper noted that, while Apple will continue to dominate, growth is expected to continue for all three digital wallets, which increased […]

Westpac customers can now use Samsung Pay

Westpac has today announced their debit and credit card holders can now use Samsung Pay – a first move from the big bank outside their own app and payment technology. While they may have been fighting to collectively bargain with Apple for access to Apple Pay it seems Westpac were happy to jump on board Samsung’s digital wallet offering access to their customers and becoming the first major bank to support Samsung Pay. Alongside Citibank and AMEX, Westpac customers can add their debit and credit cards to access tap and go payments from their phone or Samsung smart watch. Richard Fink, Vice President, Mobile Division at Samsung Australia said: “We […]

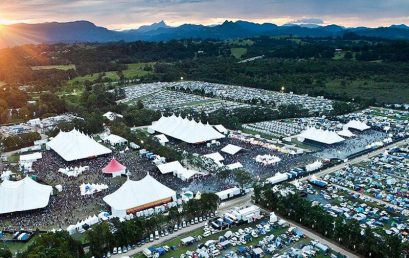

From hippie to hi-tech: Byron Bay Bluesfest ditches drink tickets for RFID microchip wristbands

WHAT will the hippies say? Drink tickets will make way for microchip technology at this year’s Byron Bay Bluesfest in a move set to divide the counterculture community of northern NSW. RFID (Radio Frequency Identification) wristbands will serve as ‘digital wallets’, replacing the traditional drink ticket system when the five-day annual Easter music festival opens on Thursday. Increasingly popular at overseas events, RFID technology uses radio waves to read and capture information stored in wristbands to simplify entry, reduce paper tickets and ticketing fraud, slash queues for drinks and ATM machines and minimise the need to carry large amounts of cash to events. The new Bluesfest RFID wristbands will give […]

Perth fintech Peppermint Innovation provides payment services to the unbanked in the Philippines

There is much to debate about the growth of Australia’s startup ecosystem, but it is a truth almost universally (well, in Australia, at least) acknowledged that the local fintech sector is doing well, bolstered by government support and corporate involvement. While most startups look to develop sophisticated products and services to tackle problems across every niche imaginable in the sector for savvy local consumers and companies, Perth fintech Peppermint Innovation thought there were significant opportunities to be found with those entirely new to banking. Founded by brothers Chris and Anthony Kain, who grew up in the small town of Narrogin, the company is providing mobile remittance services to the unbanked […]

Fintech firm’s education offering to merge soft, practical skills

Online learning business knowITdigital has partnered with Monarch Institute to roll out a diploma and advanced diploma of financial planning for the 4000 subscribers to its wealthdigital tool, with content set to cover a broad spectrum from behavioural science to policy. The fintech firm’s offering will be designed as the first step in preparing planners or prospective planners for the new education standards, due to become mandatory from 2019. The firm also plans to replicate the model for the accounting profession eventually. Monarch Institute chief operating officer Nick Chapman says the courses will merge practical elements and soft skills with the more traditional, technical content you would expect from a […]

Westpac CEO Brian Hartzer pledges bigger tech start-up focus

Westpac chief executive Brian Hartzer has said the ability of the bank to partner, acquire and invest in the growing band of emerging fintech start-ups will become increasingly central to the bank’s future survival. Speaking at the annual Australian summit of US cloud computing giant Amazon Web Services in Sydney on Wednesday morning, Mr Hartzer sought to demonstrate how the 200-year-old institution has evolved to adapt first to changing scientific and technological advances throughout its history. However, he conceded that the bank had recognised that it could no longer expect to compete with the advancing capabilities offered by new technologies, without aggressively targeting the start-up sector. “We can adopt techniques […]

Banks must partner to win disruption battle

Colin Barnard, industry leader for finance at Google Australia, has some good news for the nation’s banks. “I don’t think Google ever really wants to become a bank,” he told The Australian Financial Review Banking and Wealth Summit in Sydney on Wednesday. But Mr Barnard also had a warning for financial services companies that believe they can see off the army of disrupters on their own. “You can partner and become rich, or you can be lonely and be poor, and eventually die,” he said. The sentiment was echoed by Helen Lorigan, who is an advisory board member of fintech start-ups HashChing and Investfit and is a venture partner of […]