RBA warns the banks ‘don’t be stingy’

The Reserve Bank of Australia has warned banks to loosen up their lending practices when approving home loan applications. Following the Royal Commission banks have become cautious and their frontline lending staff are knocking back home loan applications which usually would get approved. Speaking at a function in Perth, Reserve Bank assistant governor Michelle Bullock said, “we are out there telling banks, and asking banks to tell their frontline staff, don’t be too stingy here.” Loans.com.au CFO James Austin tells Ross Greenwood staff need to be more consistent when granting credit. “It’s a lack of consistency in a credit application of the policy, it’s not the policy itself. To read […]

What Apple’s credit card means for Fintech

To the traditional financial sector’s dismay, nightmares have become reality and Apple is now a banking player. After years of discussion about whether Big Tech corporations will enter this domain, details of a payment card were unveiled, threatening to blow all other newcomers out of the water. Apple Card, launched in partnership with Mastercard and Goldman Sachs, will leverage the success of Apple Pay and will be available as a built-in feature within the Apple Wallet application on iPhone. Boasting the promise of a “healthier financial life,” the new credit card will also offer 2 percent cashback on all transactions – which they will receive on a daily basis, making […]

Pay-passing the hat around: From buskers to churches, a cashless society is Australia’s future

It’s becoming ever more apparent that as a society, we’re veering more towards being completely cashless, with solutions for giving and receiving money continually popping up and challenging everything we thought we knew about transacting. Not only is new technology and state-of-the-art security helping to boost consumer confidence when it comes to transacting electronically, but financial technology or ‘fintech’ is streamlining our financial interactions — making it easier and more reliable than ever before. According to the RBA, in the early-2000s, Australians went to an ATM an average of 40 times per year, but today, we go to an ATM about 25 times a year — a downward trend that is […]

Australia’s Consumer Data Right to open banking

by Doug Morris, CEO, Sharesight In collaboration with Fintech Australia, Sharesight has officially endorsed a submission on the Treasury Laws Amendment (Consumer Data Right) Bill 2019 that seeks to create the Consumer Data Right (CDR) with an amendment to the Competition and Consumer Act 2010. The Consumer Data Right (CDR) will mandate that banks and financial institutions (before later extending to telecommunications and utility providers) make it easy, safe, and practical for consumers to share their data with third parties — including competing services. It’s one of several critical ingredients needed to improve the financial outcome for Australians. Open Banking initiatives are already in place in the UK, and progress […]

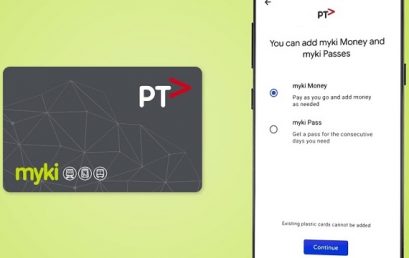

Melbourne commuters will soon be able to ditch their Myki and use their mobiles instead

Melbourne commuters will be able to ditch their Myki and use their Android smartphones to pay for public transport starting Thursday, but users of Australia’s most popular smartphone, the iPhone, are going to have to wait. Android users will be able to use Google Pay to handle their public transport expenses with a minimum top-up of $10, Public Transport Victoria said. This will remove the need for users to physically carry their Myki card. As long as the user is running the Android 5.0 operating system and has a near-field communication chip for contactless transactions, they’ll be able to use the system. Apple smartphone owners will have to wait for […]

Apple Card is a credit card you can sign up for and start using with your iPhone

Apple’s getting into the credit card business with Apple Card, a new way to pay if you own an iPhone. It’s a credit card directly from Apple housed in the Wallet app, with no fees, lower interest rates, cash rewards, while also being private and secure. The announcement comes from the company’s event in Cupertino, California, where it debuted other services like Apple TV Plus, Apple Arcade, and Apple News Plus. Apple said retail acceptance of Apple Pay, which allows for contactless payments with your iPhone, is almost at 70 percent in the U.S., and in countries like Australia, it’s at 99 percent. Apple Pay will be in more than […]

Borrowers switch to P2P lending for home loans

The irresponsible lending practices uncovered by the year-long inquiry by the Royal Commission on big banks seemed to have pushed borrowers to alternative lending providers, the CEO of peer-to-peer loan provider SocietyOne said. SocietyOne’s Mark Jones told Yahoo Finance that peer-to-peer loans have already gained traction in the industry. In fact, figures from the Australian Bureau of Statistics show that personal loans’ share of the lending market doubled from 14% to 28% between 2010 and 2018. Meanwhile, data from CommSec reveal that borrowing from non-bank institutions grew 10.3% in August 2018. “The reality is people trust the big four banks as secure, and they actually trust their local branch manager. […]

Asia Pacific look towards embracing technologies to advance their digital transformation strategy: F5 Networks survey

Asia Pacific organisations are keenly taking advantage of embracing emerging technologies to accelerate their digital transformation projects. F5 Networks’ (NASDAQ: FFIV) latest 2019 State of Application Services report revealed that 41 percent of Asia Pacific organisations are employing containers, and taking advantage of agile development methodologies to deliver applications smarter and faster. While such shifts present new opportunities for automation and agility, complexity levels also arise; leaving organisations with additional challenges such as enforcing consistent security and optimising reliable performance standards. “As Asia Pacific businesses look to further advance their ongoing digital transformation initiatives, the ability to modernise its application portfolio and infrastructure is taking center stage,” said Adam Judd, Senior […]