Sharesight shares who is (and isn’t) choosing the most popular ASX and US stocks of 2021

We’re all very aware that “Past performance is not an indicator of future results.” But when you have access to the annual trading data of over 300,000 investors using the Sharesight portfolio tracker, you might want to at least factor it into your investment strategy for 2022.

And while that data invaluably showed which assets in the US and Australian markets were the most-traded between Jan to Dec, it also revealed a key difference in mindset when comparing Sharesight users in the Americas vs. those in Aus, NZ and the UK – a mindset that plays a huge role in determining who trades in what, and where.

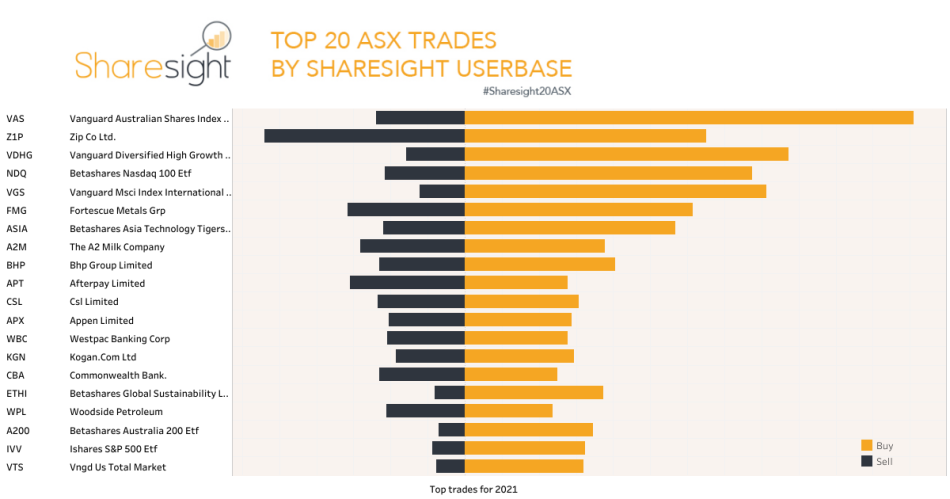

Let’s start by looking at what users were doing in Australia.

While the table above reveals a broad and diverse market appetite, emergence from the pandemic kept sentiment concentrated in the Buy-Now-Pay-Later (BNPL), mining and technology sectors.

Buying was overwhelmingly led by ETFs, with Vanguard’s ETF triple-threat of Australian Shares Index (ASX: VAS), Diversified High Growth (ASX: VDHG) and International Shares (ASX: VGS) dominating the field by a significant margin.

Sell trades in BNPL were strongly led by Zip Co (ASX: Z1P), which experienced a dramatic spike in its share price in February. This was followed by a steep drop that, once it bottomed out, was then largely maintained for the remainder of 2021.

Afterpay (ASX: APT) shone early by hitting an all-time high and managing to continue its run in 2021 as the most favoured holding in the financial sector, followed by Westpac and Commonwealth Bank, which both dipped toward the end of the year. And of the top 20, the Betashares A200 ETF was a popular purchase to hold onto.

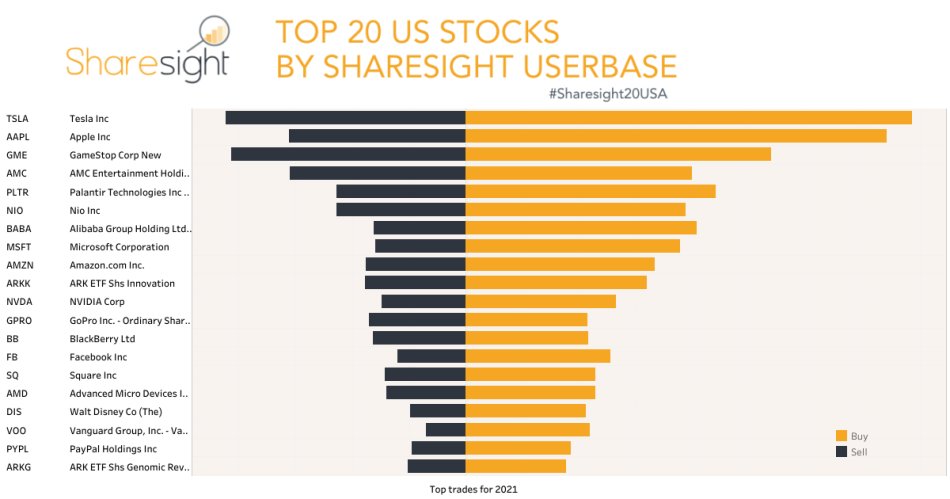

The top 20 US stocks traded by Sharesight users in 2021

Meanwhile, across the Atlantic, investors who were looking for reassurance as a tonic to global uncertainty turned to profile and publicity, as demonstrated by the continuing attractiveness of media-darlings Tesla (NASDAQ: TSLA) and Apple (NASDAQ: AAPL), as well as Gamestop (NYSE: GME), AMC Entertainment (NYSE: AMC) and Blackberry (NYSE: BB), which all peaked earlier in the year on the back of influential social media commentary.

And interestingly, there was more than just a trending tweet that GameStop and Tesla had in common; they were both also the most-sold shares among Sharesight users.

In terms of tech stocks, users concentrated their trading on long-standing favourites Amazon (NASDAQ: AMZN) and Microsoft (NASDAQ: MSFT).

Overall, it was a year of strong returns for US markets, with stocks bouncing back to pre-pandemic levels on the back of elevated domestic stability and confidence.

Who’s making local vs global investments in Australia and the US?

Upon closer examination of the data, an interesting difference emerged when Sharesight users in the US and Canada were compared to those in Australia, New Zealand and the UK:

- 98-99% of North American investors only invest in their own domestic markets.

- Conversely, over 17% of NZers, 19% of Aussies and 21% of investors in the UK invest in markets outside their own.

So why the extreme reluctance by those in Canada and the US?

It’s a fact that the American markets are the largest and most diverse in the world, so those investors might be excused for not feeling the necessity to investigate opportunities further afield. It could also be argued that, as many North American companies operate internationally, investors feel they’re embarking on a de facto global diversification even if they are still only investing locally.

But whether it’s for those reasons or any others, the clear trend is that US and Canadian Sharesight users overwhelmingly prefer to trade in entities and brands that they know, in stark contrast to users elsewhere who typically are more active in venturing into equity and debt markets located beyond their own shores.

But does staying almost exclusively local mean missing too many opportunities elsewhere? Does a lack of an international appetite increase the exposure to risk? And which mindset sits most comfortably with you when it comes to balancing returns with diversification?

Sharesight’s CEO Doug Morris added, “Time and time again, we see investors favour their domestic markets, nowhere is this more pronounced than in North America where we see investors in Canada and the US almost exclusively investing in their local markets. We always recommend investors look closely at their asset allocation across different industries, sectors and geographies with tools like Sharesight’s Diversity Report.”