Congratulations to the fintech finalists for the Women in Finance Awards 2019

Here is the list of the fintech finalists (only) for the Women in Finance Awards 2019. Congratulations and good luck!

RBA warns the banks ‘don’t be stingy’

The Reserve Bank of Australia has warned banks to loosen up their lending practices when approving home loan applications. Following the Royal Commission banks have become cautious and their frontline lending staff are knocking back home loan applications which usually would get approved. Speaking at a function in Perth, Reserve Bank assistant governor Michelle Bullock said, “we are out there telling banks, and asking banks to tell their frontline staff, don’t be too stingy here.” Loans.com.au CFO James Austin tells Ross Greenwood staff need to be more consistent when granting credit. “It’s a lack of consistency in a credit application of the policy, it’s not the policy itself. To read […]

Fintech unveils mortgage under 3.5%

Fintech and online lender loans.com.au has unveiled its newest home-loan offering for owner-occupiers with a low interest rate of 3.48%. Dubbed the Smart Home Loan, the mortgage product is a principal-and-interest loan that has no ongoing fees and has a comparison rate of 3.5%. The product has a maximum loan amount of $1m and has several features such as redraw facilities and the ability to split and make additional repayments. Homebuyers can borrow as much as 80% of the value of their targeted property. Loans.com.au managing director Marie Mortimer said the new home-loan product aims to drive competition in the mortgage space and provide other options for borrowers who are […]

How Westpac is investing in fintechs and spending $1 billion on digital transformation

Westpac’s annual results show how far the bank has gone to transform itself into a digital showcase and how it has been heavily investing in the rise of disrupting fintechs. Out of a total investment of $1.4 billion, the bank spent more than $800 million in system upgrades, digital transformation, and innovation. CEO Brian Hartzer says the focus has been on delivering technology platforms, while simplifying and automating processes to make banking easier. “We have already migrated 100 applications onto our cloud infrastructure platforms which are now largely complete,” he says. “Additionally we have over 120 APIs in production and another 180 in development.” Among digital initiatives are Siri for […]

uno Home Loans appoints Anthony Justice as CEO

Online mortgage broker uno Home Loans has appointed Anthony Justice to the role of Chief Executive Officer. Anthony joins uno having spent the last decade in senior management roles in the financial services industry, including CEO of IAG’s Australian Consumer Division. uno Home Loans Chairman Abi Cleland said: “Anthony has extensive financial services experience; an impressive track record of leading and transforming customer-focused businesses; and strong alignment with uno’s values.” “We are delighted Anthony has come onboard to lead the charge as uno ramps up its growth trajectory and continues to shake up the home loan industry.” Anthony Justice said: “Getting a home loan is one of the biggest financial […]

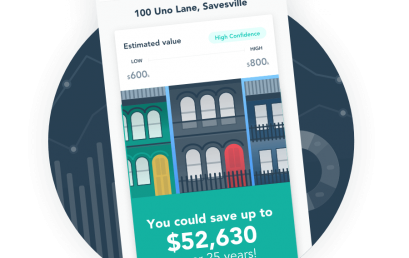

uno cracks the formula for 10-minute home loan recommendations

Online mortgage broker uno Home Loans has introduced technology that delivers refinancers a credit proposal for a cheaper home loan in the time it takes to drink a coffee. Watch the video here. The new refinancing pathway on uno’s platform digitises the process to combine a property valuation; ID verification; instant credit check; collection of current loan details; verification of income, expenses and liabilities; and assessment with credit policies from nine lenders. This expedited process – which would take days with a traditional broker – addresses a major barrier to more Australians refinancing and saving. uno Home Loans Founder and Chief Innovation Officer Vincent Turner said, “Many Australians know they […]

The Finnies. The Winners!

Congratulations to the 2018 Finnie Awards Finalists and Winners! FinTech Organisation of the Year WINNER: Afterpay FINALISTS: ● Afterpay ● Avoka ● BRICKX ● Class Limited ● Cover Genius ● Flamingo AI ● Invoice2Go ● MoneyPlace ● OnMarket ● Prospa ● RateSetter Australia ● SocietyOne ● Stockspot Emerging FinTech Organisation of the Year (company must be <2 years old) WINNER: Civic Ledger FINALISTS: ● Civic Ledger ● Finch ● InDebted ● LanternPay ● Link4 ● Longevity App ● Look Who’s Charging ● Medipass ● Till Payments ● TIQK ● TravelbyBit Outstanding FinTech Leader of the Year (can be from any field) WINNER: Katherine McConnell – Founder and CEO, Brighte FINALISTS: […]

FinTech Australia announce finalist for The Finnies 2018

FinTech Australia and Jobs for NSW have come together for the second year to host the national fintech awards, The Finnies. The Finnies will culminate in a Gala Awards Night Wednesday 13 June 2018 in Sydney. For more information go here. Here is the full list of finalists for the 2018 Finnies: Best Workplace Diversity ● BRICKX ● FirstStep Investments ● Link4 ● Valiant Finance Emerging FinTech Leader of the Year ● Brad Delamare – CEO, Tank Stream Labs ● Louis Edwards – Head of Renewable Energy Finance, RateSetter Australia ● Nick Molnar – Co-Founder & CEO, Afterpay ● Jack O’Reilly – Director, funding.com.au ● Rebecca Schot-Guppy – Community Manager, […]