Moneysoft enters new partnership with Mortgage Choice

Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals. Mortgage Choice Financial Planning will offer the tool under the name of MoneyTrack as a part of their cash flow coaching service. Tania Milnes, general manager of Mortgage Choice Financial Planning, said the new tool will help its national network of advisers to enhance the affordable and transparent advice they provide to clients. “The introduction of MoneyTrack will provide a robust basis for the advice we currently provide to help manage their cash flow,” she said. “It gives clients an easy to understand tool […]

Fintechs like Hashching cash in on bank lending limits to curb property boom

As regulators weigh new limits on bank lending to cool the housing boom, their impact may be muted as tech-savvy borrowers turn to fintechs to access cheaper rates offered by non-bank lenders. Hashching is raising $6 million of fresh equity on the Neu Capital fundraising platform in a deal valuing the Sydney-based start-up – which gives borrowers access to the best interest rates negotiated by mortgage brokers – at $40 million. Since it was set up in August 2015, Hashching has received applications for $5 billion of home loans, which has doubled in the last five months. Around 20 per cent of loans are made to property investors. On the platform, borrowers are […]

Banks need to contend with YOLO and FOMO for market share

The attitudes and expectations of Millennials are shaping up as a key hurdle for banks, as younger customers experiment with new financial service providers and defer major investment decisions such as property purchases. Consultants at KPMG say the results mean that banks will have to learn the meaning of YOLO (you only live once) and the importance of FOMO (fear of missing out) in order to adapt their strategies and capture this valuable demographic. The findings are contained in the consultant’s third annual survey of the banking habits of Generation Y titled “Banking on the Future” which surveyed 1400 professionals aged between 18 and 30 years old. In what amounts […]

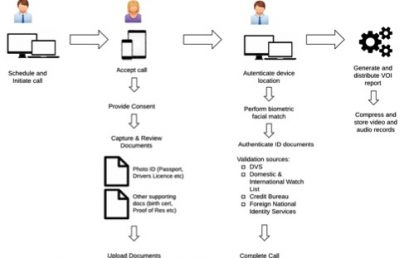

Regtech player e4 introduces Australia’s first-ever Virtual ID solution

South African regulation technology company e4 has arrived in Australia with the promise of enhanced corporate regulatory compliance and superior customer convenience, thanks to its introduction of Australia’s first real-time, ‘virtual’ alternative to face-to-face ID verification. e4’s new Virtual VOI (Verification of Identity) platform delivers Australian businesses the first ever digital opportunity to ensure compliance with global and local anti-money laundering and counterterrorism financing (AML/CTF) standards, increased customer and workforce convenience and a substantial saving against other ID verification services in operation across the country. Founded in 2000, the e4 Group has already become a dominant and trusted software and technology services provider to the banking, legal and […]

The Benzinga Global Fintech Awards – entries closing soon

The Benzinga Global Fintech Awards May 11, 2017 in New York, is the premier event in Fintech, celebrating financial innovation from around the world. The Benzinga Awards is a competition to showcase the companies with the most impressive technology, who are paving the future in financial services and capital markets! Applications are still open, so apply now before the March 17 deadline. At the event, you’ll get a first look at groundbreaking technology, innovative platforms, and the chance to network freely with top industry professionals. Over 550 FinTech CEOs, C-suite executives of financial institutions, VCs, press, and others attended the 2016 Benzinga Fintech Awards. 45 exclusive exhibitor spots on the show floor […]

Adelaide start-up and fintech company Joust to launch in New South Wales under NOVA Entertainment Group funding deal

A MAJOR entertainment company has thrown its financial support behind Adelaide-based technology start-up Joust, allowing the company to expand its home loan auction service into New South Wales. The Wakefield Street business today announced it had successfully raised another $400,000 and secured NOVA Entertainment Group as a strategic investor. The company, which operates in SA and Victoria, says the funding takes to almost $2 million it has raised since its inception in early 2015. Co-Founder and managing director Mark Bevan said 650 customers have used Joust to seek a better home loan interest rate and that the value of home loans “jousted” was already more than $250m. “We now have […]

Dart aims for a United States of Fintech

Australian tech entrepreneurs have launched a new digital home for the global fintech community, providing an agnostic platform that founders hope will one day become the seat for an inclusive and encyclopaedic fintech commonwealth. Founder and CEO, Cameron Dart, told AB+F that the International FinTech platform, combines a web portal and directory to meet growing demand from the global community to have a dedicated, online and natively fintech presence for a sector that transcends borders. “We like to think of it as the beginnings of a LinkedIn for fintech,” Dart said. This week’s launch, built on the back of the original Australian FinTech, already encompasses more than 1,000 global fintech companies […]

Australian FinTech launches International FinTech platform

The team behind the highly successful AustralianFinTech.com.au, this week launch their International platform, InternationalFinTech.com, aimed at connecting the FinTech industry on a global scale. Founder and CEO, Cameron Dart, says International FinTech has been born on the back of the highly successful Australian FinTech platform and growing demand from the global community to have a dedicated online presence for their sector. “International FinTech mirrors the Australian FinTech platform, including a dedicated industry newsfeed and a comprehensive directory of FinTech companies globally. “The site also aims to educate users of new financial technologies such as peer to peer lending and cryptocurrency, all presented in simple terms with no financial jargon” says […]