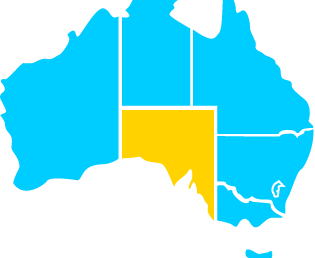

SA govt launches blockchain challenge to spur industry

Offers $100,000 prize pool to entrepreneurs. The South Australian government is hoping to forge its position as Australia’s “blockchain capital” through a new $100,000 challenge for entrepreneurs. On Wednesday it launched the blockchain innovation challenge, inviting South Australian residents (or those willing to relocate) to pitch ideas that solve problems using blockchain. The government hopes to use the competition as a means to attract blockchain enterprises and make the state as Australia’s “blockchain capital”. “The South Australian Government recognises this potential and is working to create the right environment for blockchain enterprises to thrive,” it said. It is calling for “well-thought out projects” that hold the promise of benefiting the state […]

Australia punches above its weight with Blockchain Innovation

ACS, the professional association for Australia’s ICT sector, today announced the publication of Blockchain Innovation: A Patent Analytics Report at Barangaroo, Sydney. Through providing insight into innovators in blockchain technology – based on patents filed – the report will assist both businesses and governments in understanding the technology and the degree to which it is a critical enabler for continued economic growth. ACS President Yohan Ramasundara said, “Blockchain has been hyped as one of the most transformative and disruptive technologies on the immediate horizon. With the global market forecast to grow to US$60 billion by 2024, Australian businesses and governments alike have ample opportunity to leverage the technology as it matures.” The […]

Temenos acquires Australian banking fintech Avoka for US$245m

Temenos, the banking software company, today announces it has agreed to acquire Avoka, a leader in digital customer acquisition and onboarding, subject to regulatory approvals. The acquisition further strengthens the Temenos Digital Front Office product, which has over 300 banking clients and has been recognized as a leader by top analyst houses such as Forrester and Ovum. The Avoka platform will be integrated with the Temenos Digital Front Office product, providing banks with a comprehensive single solution for their omni-channel digital banking needs. Temenos has agreed to purchase Avoka for USD 245 million. Through this acquisition, Temenos continues to bring innovative capabilities to its Digital Front Office product that includes […]

Keeping up with data in the financial landscape of the future

By Scott Hubbard, Managing Director ANZ, MapR Changing consumer behaviour and the growing need for customer centricity are reshaping the banking and financial services industry (BFSI), however underpinning this is data and applications. We are now living in a world where a massive amount of data is being generated by an increasing number of sources and it’s up to organisations to take advantage. In fact, IDC reports that worldwide revenues for big data and business analytics will reach $260 billion USD in 2022. For banks, the increase in both scale and speed of their applications and data processing, means they can leverage data analytics to create better services for […]

New user-focused offering for corporate super comes at turning point for the sector

With super funds looking to improve transparency and customer experience, GBST has today announced a new user-focused offering for corporate super providers. The launch comes at a time when the sector is looking for ways to evolve their offerings in light of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services. The enhanced corporate super offering allows funds to offer a user-focused experience, with a modern, intuitive interface to meet employer and member needs. It features straight-through processing (STP) capability so employers can easily manage their accounts and access their employee’s information online, improving user engagement and reducing administration costs for the fund provider. This is an […]

Fintech joins express loans partnership

A digital mortgage service fintech has announced it will join a partnership to create fast, paperless home loans. Tic:Toc and Bendigo Bank announced recently they would be teaming up to offer “express” loans. Now, legal fintech LeadPoint, which specialises in providing automated home loan documentation, has announced it would join them. The group has generated more than 50,000 home loan contracts through its platform since it launched in 2013. LeadPoint’s involvement in Bendigo Bank Express is the next phase of LeadPoint’s partnership with Tic:Toc loans, which already offers ‘webmortgages’ loan documentation as part of its instant home loan assessment and approval platform. LeadPoint uses its proprietary platform to produce digital […]

Australian fintech Ignition forms multi year multi million dollar partnership with tier one bank

Bank of Ireland’s Seán Ó Murchú joined Manish Prasad and Alan Quinlan from Ignition Advice in today launching a new digital advice platform for Irish consumers. Seán Ó Murchú, Director, Wealth Advice and Distribution at Bank of Ireland, said, “Creating a single, digital advice platform will have a transformational impact on the Irish market,”. Ignition Advice technology will support Bank of Ireland customers across all areas of their financial lives, from financial wellness and saving, to investment and insurance. Scalable solutions allow the bank to offer digital financial advice to all of their customers, while the Ignition Advice hybrid model allows the bank to fully integrate digital advice with telephone […]

American Express praises Ripple for cross-border payments, calls blockchain technology ‘very promising’

American Express is at it again with positive comments on blockchain technology and praising Ripple.