Saxo Bank receives credit rating upgrade to ‘A-’ from S&P Global Ratings

Saxo Bank today announces that S&P Global Ratings has upgraded its long-term issuer credit rating to ‘A-‘ from ‘BBB’.

Sole trader turnover at its worst in two years but optimism reaches a new high

The start of the year has proved rocky for Australia’s 1.5 million sole traders, with over a third (38%) experiencing a decline in revenue.

Introducing Australian FinTech’s newest Member – Flash Payments

from foreign exchange to digital payment solutions, Flash Payments provide companies with reliable and compliant technologies to scale at speed.

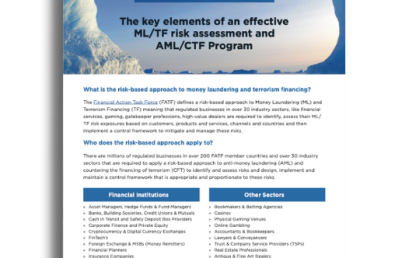

Is your business fully aware of its vulnerability to money laundering and terrorism financing risks?

As you know, money laundering and terrorism financing laws are risk-based. This means that regulated businesses like yours must conduct business-wide ML/TF risk assessments.

International fintechs Paysend and Currencycloud sign major global expansion deal

Currencycloud and Paysend have announced a major expansion to their longstanding partnership that will see Paysend expand its services around the world.

Raiz Invest finalises exit of Indonesian operations

ASX-listed Raiz Invest, a leading investment app, have announced that it has finalised the exit of its Indonesian Joint Venture operations.

At your service: how Australian financial institutions can elevate their customer experience in 2024

Banks and other financial services providers know the way customers are choosing to engage with them is evolving fast

Tyro to offer complimentary EFTPOS readers to charity and community organisations

Tyro is offering charity and community organisations complimentary EFTPOS readers to help them take payments, donations and fundraising with ease.