Non-bank lender Firstmac prices $1.2 billion Residential Mortgage-Backed Securities issue

Firstmac has dispelled fears about weakness in the Residential Mortgage-Backed Securities (RMBS) market by successfully pricing a $1.2 billion issue at a tight yield.

Wisr delivers 55% revenue growth

Wisr saw operating revenue growth of 55% to $91.9 million compared to FY22 figures of $59.4 million and their loan book also grew at a rate of 19% to $931 million

How Alex Bank makes loan decisions in under 5 minutes

Alex Bank is Australia’s newest Authorised Deposit-taking Institution (ADI), built on a completely digital platform.

Compare n Save integrates with MacroBusiness to provide a hassle-free loan comparison solution

Compare n Save, a mortgage broking Fintech, have launched its integration with Australia’s leading business and investment blog, MacroBusiness.

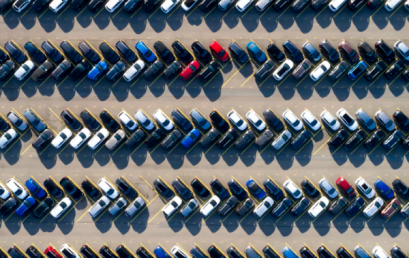

Driva partners with Carsales to enable seamless digital finance experience

Driva, an Australian fintech platform that helps customers seamlessly obtain finance for personal loans, has launched a multi-year partnership with carsales.com.

The FinTech Report Podcast: Episode 40: Anthony Baum, Founder & CEO, Tic:Toc

“Banking will split into three categories: Brand, Technology and Balance Sheet… Open Banking is better than CCR, and calculators are redundant.”

Fintechs again feature in the 2023 Australian Mortgage Awards

The 2023 Australian Mortgage Awards are back again for another year and once again Australian fintech companies are featured amongst the finalists.

MONEYME achieves record FY23 gross revenue of >$230m, exceeding guidance

Digital lender and non-bank challenger MONEYME has achieved record annual gross revenue of >$230 million, up >60% from $143 million in FY22.