SME lending fintechTP24 lands A$585 million global debt deal with Barclays

Receivables-backed SME lending fintech TP24 has closed a A$585 million global debt deal with Barclays Bank, arranged by Australian debt advisory firm, Neu Capital.

Rollin’ with Gen Zs and Alphas: what financial institutions need to take on board

There are legions of existing customers who need to be looked after in parallel with Gen Zs and Alphas, and those older customers don’t necessarily want a 100% mobile app-based experience.

Despite low awareness, Australians prefer Open Banking: Frollo

The latest research from Frollo shows that 55% of Australians have never heard of Open Banking, and only 18% have at least a basic understanding of the concept.

Thoughtworks creates market ready personal loan product in just eight weeks for Australian financial institutions

Thoughtworks has built a new personal loan product for banks and other lending institutions in just eight weeks.

Macquarie Bank partners with Google Cloud to deliver AI-First digital banking capabilities

Macquarie’s Banking and Financial Services group, in collaboration with Google Cloud, announced new artificial intelligence (AI) and machine learning (ML) capabilities to drive improved banking experiences for its customers.

How automation helps banking institutions reduce their exposure to financial crime

The constantly evolving nature of criminal activity, regulation, technology and banking operations makes managing the financial crime lifecycle a complex challenge for banking institutions.

NAB welcomes Annature as part of new reward program for business transaction account holders

NAB has announced a strategic partnership with Annature as part of its innovative rewards program for NAB business transaction account holders.

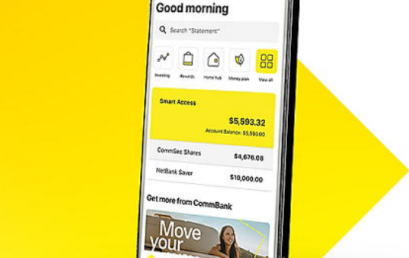

CommBank announces new reimagined banking services as increasing numbers of customers switch to digital banking

CBA has announced a series of innovations and technological advances designed to strengthen customer experience as increasing numbers of customers switch to digital banking.