The FinTech Report Podcast: Episode 43: Philippa Watson, CEO at ubank

The FinTech Report Podcast: Episode 43: Glen Frost interviews Philippa Watson, CEO at ubank.

Customers app-laud new ubank digital look and feel

UBank has revealed a new look and feel after merging with smart bank, 86 400 – becoming one team under a single brand, ubank.

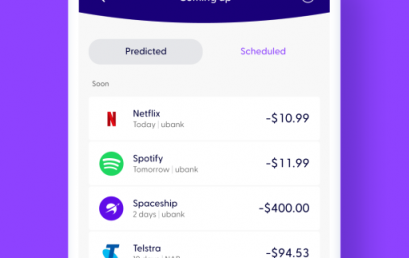

UBank adopts Basiq’s AI-powered tools to help Millennials budget

NAB’s digital bank UBank has joined forces with fintech Basiq to predict the spending of Millennials and help them save money.

UBank here to disrupt banking forever

UBank has a mandate to disrupt banking for good and to do so they have placed technology at the forefront of the customer experience.

UBank launches world’s first consumer Green Term Deposit certified by the Climate Bonds Initiative

UBank is now offering Australians with a sustainable way to invest with today’s launch of the world’s first Green Term Deposit in the customer space certified by the Climate Bonds Initiative (CBI). UBank’s Green Term Deposit is matched to a portfolio of renewable energy projects such as wind and solar power, and low carbon transport and buildings. It allows customers to use the savings in their term deposits to support a positive environmental impact, while still enjoying a high return. Certified by CBI, a not-for profit that has developed a standard for investments which address climate change, UBank’s Green Term Deposit is available to all customers with a minimum $1,000 […]

UBank launches AI mortgage application assistant

A new artificial intelligence-powered mortgage application assistant will soon be able to answer customer questions in natural language, UBank has announced. UBank has revealed that its new AI-powered digital home loan application assistant, called Mia (short for My Interactive Agent), will start answering more than 300 common customer questions in real time from late February. The NAB subsidiary, which worked with FaceMe to develop Mia, said customers will be able to converse in natural language with the AI assistant via their desktop or mobile devices at any time about their mortgage applications. For example, customers could ask about what the variable rate of a loan is or what classifies as […]

UBank announces partnership with MSA National to provide DigiDocs

UBank, Australia’s leading digital bank, has today announced a partnership with MSA National to provide its customers with a more efficient and convenient way of signing home loan documents. Known as DigiDocs, the service provides eligible customers a way to quickly and securely review and sign loan documents on their computer or mobile device quickly anywhere, at any time. Powered by MSA National and using the DocuSign platform, DigiDocs uses encryption and two-factor authentication to provide customers safe and secure processing. Anna Vincent, UBank’s Head of Customer Home Loans, said, “Getting a home loan is one of the most important decisions a person will make in their lives, and at […]

NAB’s UBank to ‘use technology as a weapon’

National Australia Bank says its digital bank UBank will take advantage of the government’s ‘open banking’ reforms by developing new ‘platforms’ that will connect users to a broad range of financial services – not necessarily NAB’s – which could open up new revenue streams. NAB chief executive Andrew Thorburn described the open data reforms as “potentially a transformational-type change” and said in an interview NAB is planning to “use technology as a weapon, not just a tool of commerce”. NAB created UBank a decade ago; its customer base has grown to 400,000, half are Millennials, and only a small minority are existing NAB customers. NAB is lifting investment in UBank […]