Australians are increasingly using their phone as a credit card: Deloitte

The pressure is on Australian banks to keep up with customer’s growing use of smartphone apps to pay for in-store and online purchases. A Deloitte survey has found the use of mobile payment solutions has grown 14 per cent over the past year, with over a quarter of respondents now using them. Mobile payment solutions include apps such as Apple Pay, Samsung Pay and Android Pay, which allow users to process payments for online or in-store purchases using the app, without having to punch in their credit card details every time. Most of these apps act as “mobile wallets”, allowing users to store their card details and authorise payments using […]

Turnbull’s banking royal commission welcomed by fintech

Malcolm Turnbull has announced plans to establish a royal commission into the banking sector, and one fintech is hopeful it will bring more competition and trust to financial services in Australia. The announcement comes following a letter from ANZ, Commonwealth Bank, Westpac and NAB to the Treasurer asking for an inquiry to restore public faith. Alternative finance and peer-to-peer lender MoneyPlace’s CEO Stuart Stoyan told Canstar a banking royal commission “has been a long time coming”. “It’s important to re-establish trust with banks and financial services more generally,” he said. “I’m hopeful it will allow us to review policies that enable fintech to provide great products and services to all […]

5 Aussie fintech firms that are shaking up the home loan business

by Richard Whitten, finder.com.au The home loan industry is about to change in many ways with these Aussie startups leading the way. The home loan market is a multi-billion dollar industry that hasn’t yet seen many of the same disruptions as other industries. But that’s about to change. Fintech companies boasting apps, algorithms, blockchains and automated platforms are all promising to make the process of buying a house easier and faster.Here are five Aussie fintech companies who are poised to shake up the home loan market. Tic:Toc Tic:Toc launched earlier this year with a headline grabbing promise: the 22-minute home loan (application that is, not your repayments). This startup’s promise […]

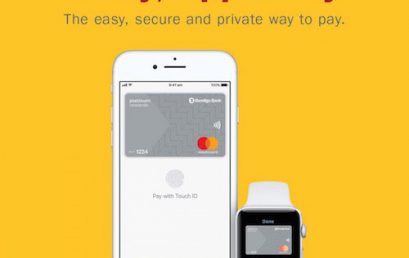

Bendigo Bank customers can now shop with Apple Pay

After battling with Apple earlier this year, Bendigo Bank has now partnered with all three major digital wallets. Bendigo Bank is the latest Australian institution to join the Apple Pay ranks. From today, Bendigo Bank Mastercard customers can use their iPhone, Apple Watch or iPad to make contactless payments. This means lighter wallets, faster transactions and even more secure payments. To link your Bendigo Bank credit or debit card with Apple Pay, you just need to open the Wallet app and tap the plus symbol in the upper-right corner. Then follow the prompts to enter your card’s security code to add your credit or debit card from your iTunes account. […]

Bitcoin is safe, sustainable and here to stay

“Tulips”, “Ponzi scheme”, “fraud”, “only used by criminals and drug dealers’” have been some of the descriptions of Bitcoin in the past few weeks. Whether or not “fake news” is driving the price, the mystique of Bitcoin is enhanced by the fact that its “true” value cannot be determined using traditional financial analytical techniques. That mystique, however, does not justify the gulf between the bad press and what the facts show. For instance, former ASX boss Elmer Funke Kupper’s imputation that Bitcoin is “trade in drugs and other illegal products” drew instant scorn from Marco Santori, a regulatory expert and adviser to the International Monetary Fund at Cooley, a New York law firm. […]

VCs target Australian blockchain and cryptocurrency firms with $44m in funds

Start-ups with designs on making it big in the fast-growing world of blockchain and cryptocurrencies will be targeted by two new funds focusing on the Australian market, with almost $44 million to spend. Apollo Capital, founded by venture capital fund Dominent Venture Partners’ Domenic Carosa and Holger Arians and Wall Street veteran Henrik Andersson, is attempting to raise a minimum of $30 million and will specialise in crypto asset investments, which it defines as digital currencies, blockchain-based assets and initial coin offerings. At the same time an $80 million global blockchain development fund, NEM.io Foundation, is expanding to Australia, with its global director of partnerships and strategic alliances, Jason Lee, […]

Sydney fintech Waddle just secured a $50 million debt funding round

Online cash flow lender Waddle has secured a $50 million debt funding facility, as it revealed it almost doubled its lending volume in the last financial year. The software is integrated into popular small business accounting packages like Xero, Intuit and MYOB to be able to look at which invoices are overdue for its customer. Based on this information, money is instantly lent out at the click of a button. The Sydney startup saw a 84% spike in lending volume for the 2017 financial year, which exceeded the initially expected mark of $30 million. Waddle co-founder Simon Creighton said the genre was previously “plagued” with complexities like factor pricing, contracts […]

Fortress backs $120m capital raising by MoneyMe

Global credit investor Fortress Investment Group will invest $100 million in debt capital to support MoneyMe’s consumer lending growth as the fintech considers an initial public offering in early 2019. Fortress’s investment is part of a $120 million asset-backed securitisation deal, which also includes a $20 million bond, issued by Evans & Partners, which was oversubscribed. MoneyMe, which has made $150 million in personal loans to 70,000 customers in the past four years, is both cash flow positive and profitable, very rare for an Australian fintech. Established in 2013, its net loan book is growing at $1 million each week, as it targets the credit card portfolios of the major […]